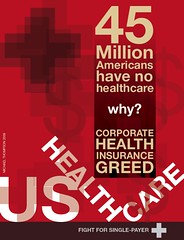

Image by freestylee via Flickr

Image by freestylee via Flickr

Momma becomes preggers in Oct. of 2006... All pre-natal care is deductable.

Easter Sunday 2007 Son Matthew is in Children's hospital emergency with a racing heart (something like 180-200 beats/min.) He is visited by the on-duty doctor who calls in 2 cardiologists. Matthew is attended by a host of nurses and technicians plus an echo cardiogram...cha-ching. (Fortunately, it turned out to be a non life-threatening condition). But, he does need medication.

Both oldest boys are in counseling for behavior/emotional issues. One is on meds for that as well. (They've inherited way too much daddy genes). Mom and dad are also in counseling both marriage and individual. Insurance pays for 15 visits per person per year. Plus meds for mom and dad as well.

2007 sees lots of pre-natal visits for impending birth. There are lab tests, ultrasounds, etc., etc. cha-ching, cha-ching.

Son Matthew gets whacked in the head with a golf club by the neighbor kid by accident. There's another visit to Children's emergency.

Baby Noah is born July 6, 2007. He continues to be jaundiced for several days. That means regular blood tests.

My point in all this is to illustrate why the health care thing is so important to me. Besides the $4563.00 premium paid annually, we paid $3000.00 in deductible plus co-pays on doctor visits, meds, counseling sessions, etc. $7563.00. I don't even know how much we paid on the co-pays. All told, it probably comes out to around $8500-$9000.

Now imagine a family of six with NO health insurance. Perhaps not even experiencing ½ what we went through in 2007. They would have to pay out-of-pocket for everything. But would not have the money to do so. So, the health care system absorbs that and passes it on to...wait for it...wait for it....You! and Me! And every sad chump that does have insurance and pays taxes.

We are all paying for the uninsured and under insured already anyway through cost-shifting. In the current system we're paying far more than we would in a well structured universal health care system. And we would not have to sacrifice quality of care for it.

Now imagine this: I don't pay a dime out-of-pocket for premiums, care, meds, co-pays, deductables, etc. There's $8500-$9000 in my pocket. That's approximately $7565 after taxes.

Thre's $7565 that I can use to buy materials to finish remodeling my house and put it up for sale. Or I can replace our 20 year old t.v. upstairs. Or I can put tires on my Geo Metro. Dingdingding! Economic stimulus! Imagine a whole nation with the same kind of “extra” money in their pocket. Instead of drowning-nay-going bankrupt from overwhelming medical expenses, people having disposable income to pump into the economy.

Even with higher taxes to pay for universal, single-payer health coverage, Americans would be better off in the long run.

Health providers could, over time, concentrate more on keeping people healthy rather than trying to fix what could have been prevented.

I am cautiously optimistic that congress and president Barack Obama will reform health care in some way. Unfortuately, they are not doing it right. But I'll take what I can get for starters.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c1cb52d1-84e1-4ac2-917c-feb97f27d39f)

No comments:

Post a Comment